Overview

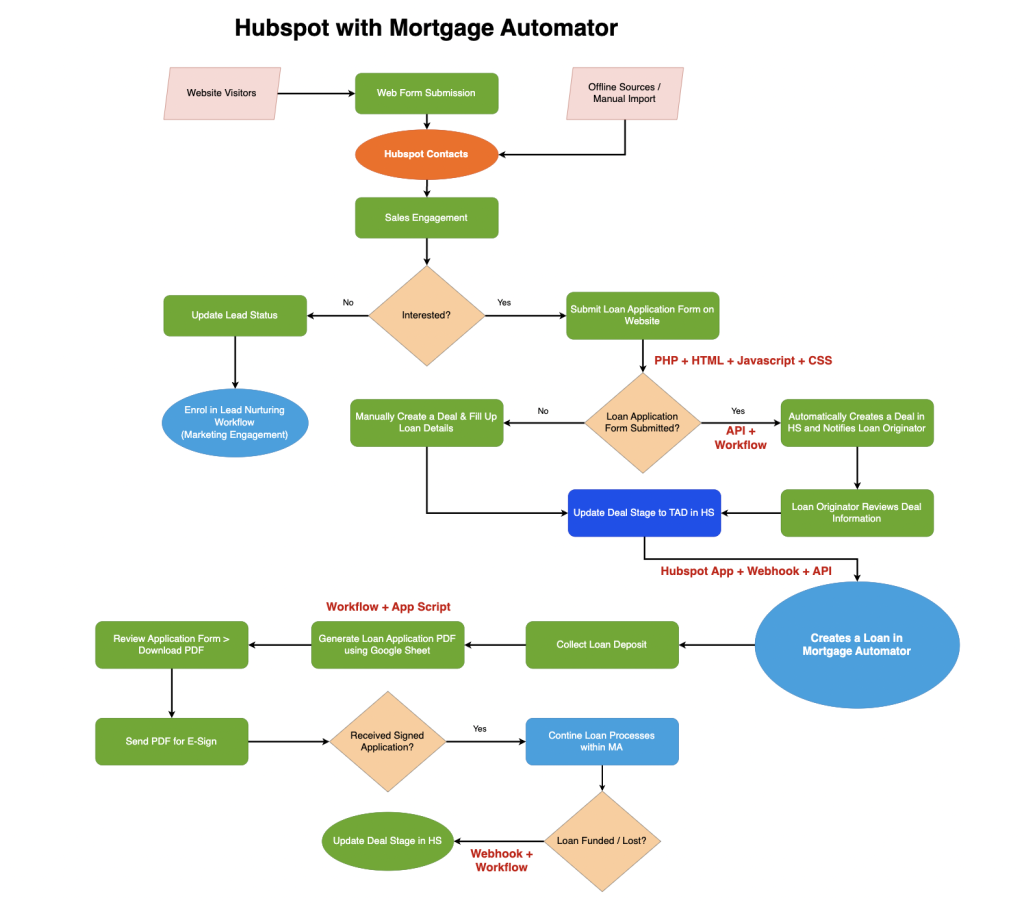

My client, a private money lender specializing in loans for real estate investors, relied on both HubSpot and Mortgage Automator to manage their business operations. They used HubSpot—with Marketing Starter and Sales Professional subscriptions—as a CRM to manage prospects and automate sales activities, while Mortgage Automator served as their loan origination and servicing platform to streamline loan processing.

Previously, their loan application and processing system involved manually filling out PDF forms, sending them to clients for e-signing, and creating loan files in Mortgage Automator. This workflow also required manually transferring data from HubSpot to Mortgage Automator each time a deal moved to a specific stage. This manual, multi-step process was time-consuming, prone to errors, and created bottlenecks, prompting the client to seek a streamlined, automated solution that would seamlessly integrate both platforms and reduce manual intervention.

Challenges

The client’s key requirements were:

- Automated PDF Document Generation: Automatically create a custom-designed loan application PDF populated with deal information and ready for e-signing.

- Automated Loan Application Submission: Applicants needed to submit a loan application form directly on the website, creating a deal in HubSpot automatically.

- Seamless HubSpot to Mortgage Automator Transfer: Client and loan details should automatically transfer from HubSpot to Mortgage Automator when the deal stage reaches a specific point (“TAD” stage).

- Customized Multi-Step Form with Validation: The website loan application form needed multi-step capabilities and custom validation, which HubSpot Marketing Starter couldn’t accommodate.

Constraints

Meeting these requirements using HubSpot’s native features would require costly subscription upgrades:

- Third-party PDF generation tool ($49/month).

- HubSpot Operations Hub Professional for webhook features ($720/month).

- HubSpot Marketing Hub Professional for customizing Hubspot forms ($800/month).

Solution Design

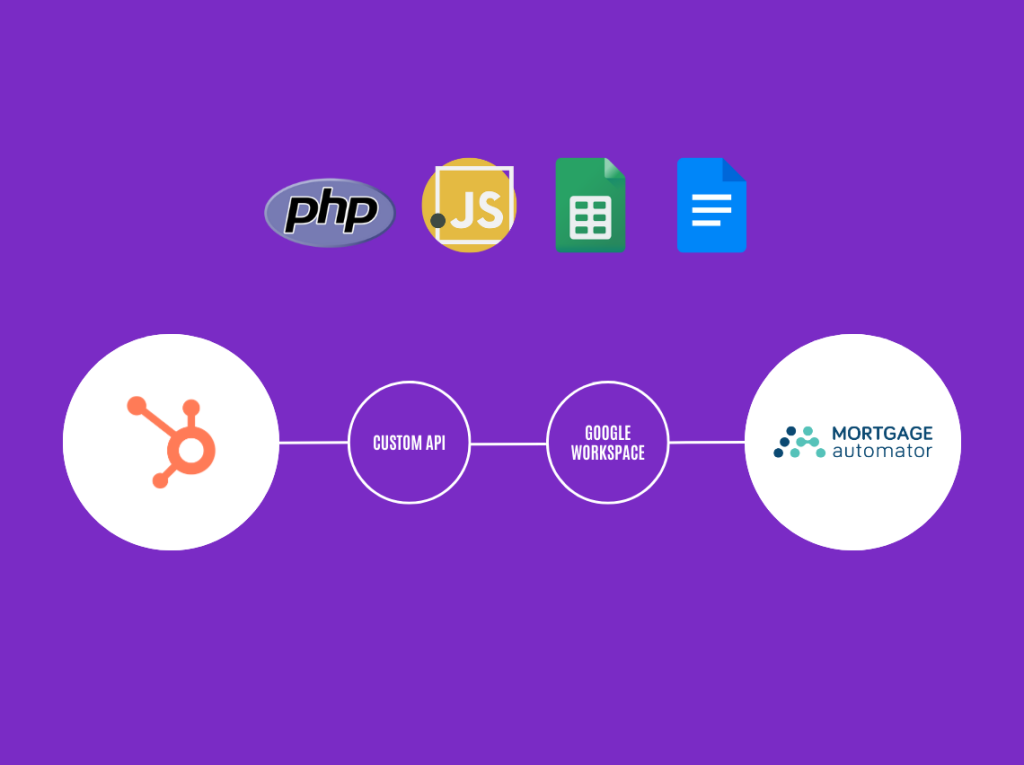

To deliver an automated solution without requiring costly HubSpot upgrades, I developed a custom solution using HubSpot’s API, Google Workspace, and Mortgage Automator:

1. Automated HubSpot Deal and Contact Creation

- Custom Properties Setup: Created a set of custom properties in HubSpot for Contact and Deal objects to store essential loan information.

- Multi-Step Custom Form: Developed a multi-step form with custom validation on WordPress, pushing data to HubSpot via the HubSpot Forms API.

- HubSpot Deal Creation: Using a custom workflow, the form submission automatically created both a contact and a deal in HubSpot, pre-populated with the applicant’s information.

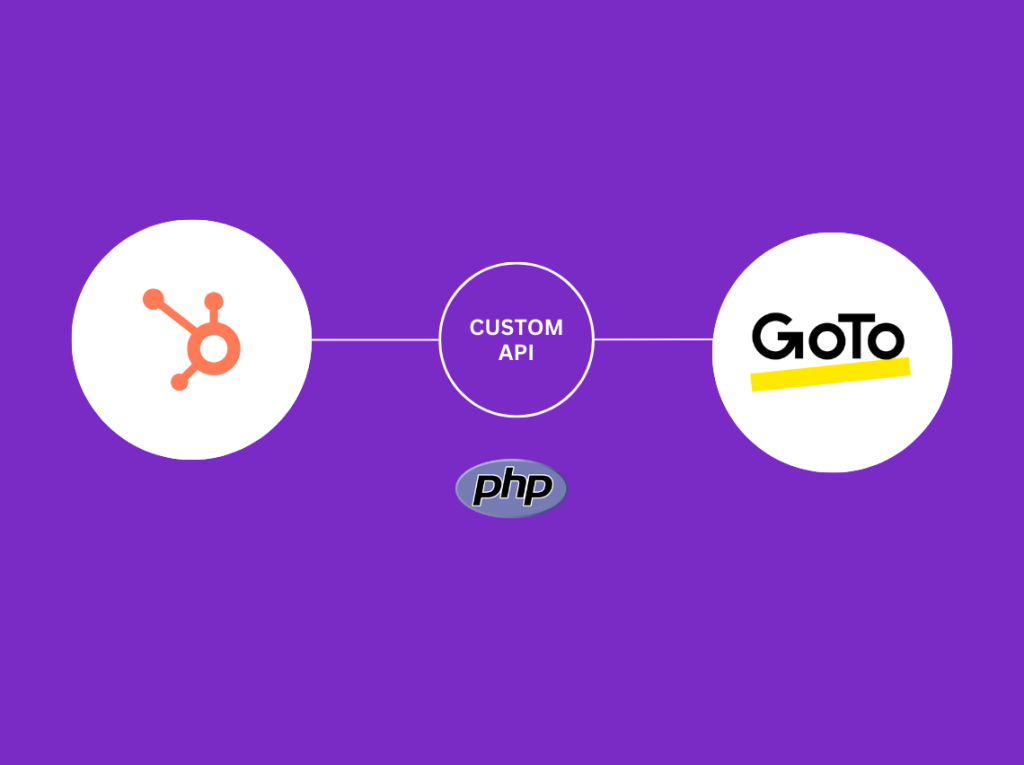

2. Custom Webhook and Integration with Mortgage Automator

- Private HubSpot App: Developed a private HubSpot app to authenticate and access HubSpot Contact and Deal data.

- Webhook Trigger on Deal Stage Change: Created a webhook using the HubSpot app to monitor changes in deal stages. When a deal moved to the “TAD” stage, the app automatically triggered a webhook call to a custom URL.

- Data Transfer to Mortgage Automator: The webhook sent detailed loan information to Mortgage Automator via API, creating a new loan application file with no manual input required.

3. Document Generation Automation Using Google Workspace

- Google Sheets and Google Docs Integration: Connected HubSpot with Google Sheets using a HubSpot workflow that populated a Google Sheet with deal information whenever a deal reached the “TAD” stage.

- Customized Google Docs Template: Created a Google Docs template with dynamic placeholders linked to data from Google Sheets.

- Automated Document Generation with Google Apps Script: Developed a Google Apps Script in Google Sheets that populated the Google Docs template with deal data, creating a customized loan application document. A manual trigger allowed users to review deal information before document generation.

- Centralized Document Storage: Generated documents were saved to a designated folder, making it easy for users to access, download, and send for e-signing.

Results

This custom-built solution provided a seamless, automated workflow that reduced manual work, improved data accuracy, and saved on recurring software costs:

- Cost Savings: Avoided the need for costly HubSpot subscription upgrades and third-party PDF generation tools, saving approximately $1,569/month.

- Efficiency Gains: Eliminated manual data entry and file creation, reducing processing time and enabling the team to focus on high-value tasks.

- Enhanced Accuracy and Consistency: Custom properties and automated data transfer reduced human error, ensuring consistent and accurate data across platforms.

- Improved Client Experience: The streamlined, web-based loan application process improved the client experience, making it faster and easier for applicants to submit loan information.

Conclusion

This case study demonstrates how custom solutions leveraging HubSpot’s API, Google Workspace, and Mortgage Automator can automate complex processes without requiring costly upgrades. My custom integration and automation not only saved the client significant monthly costs but also improved operational efficiency and client satisfaction.